Flying was the domain of only the affluent until low-cost carriers cruised into the market around 16 years ago. Since then, no-frills or budget airlines have gone from strength to strength on the back of breakneck growth in demand and now account for more than 70% of the Indian aviation market. As competition increased, airlines were forced to slash fares and only the fittest were able to survive. Over the years, several airlines, from Kingfisher to Air Deccan, went under because of massive losses. In April, debt-laden Jet Airways, an airline born out of the open skies policy of the early 1990s, was also forced to ground operations because of lack of funds.

Efforts to restart the airline are on in full swing. Can Jet, once the biggest private carrier in the country, stage a comeback in this age of no-frills domination? Hopes of a rescue are fading. Its domestic slots have already been reallocated to other airlines for a period of three months; and there are reports that Jet’s international routes, which generate more than half its revenue, could also be reallocated to other Indian airlines. Last month, its CEO Vinay Dube and deputy CEO & CFO Amit Agarwal resigned, leaving the airline rudderless. “I think as every day passes it becomes more difficult because you have to build up from scratch,” says Amar Abrol, the former CEO of AirAsia India, the Indian arm of Malaysian no-frills behemoth AirAsia.

Etihad Airways, which owns a 24% stake in Jet, has submitted a bid to invest in the beleaguered airline. Its sole bid, however, was with conditions. One of them being that it did not want to provide the “majority of Jet Airways’ required recapitalisation”—which aviation analysts peg at between $2 billion and $3 billion. Mark D. Martin, founder and CEO of Martin Consulting, says, “To revive Jet Airways you need to clear their debts of about ₹7,000-odd crore and another ₹5,000 crore needs to be infused as working capital.”

Martin adds that it might even be cheaper for an investor to start a new airline from scratch. “What stops an investor from investing ₹12,000 crore, needed for Jet Airways’ revival, into [setting up] a new airline in India? Probably, even half of that amount would suffice,” he says.

Apart from the billions of dollars needed, operationally, too, it would be a steep climb back for Jet. “For it to make a re-entry into the market, the airline would need to compete at the lowest level and grow,” says Harsh Vardhan, founder, Starair Consulting. That would mean competing with low-cost carriers such as IndiGo, SpiceJet, Go Air, and AirAsia India.

Low-cost carriers have been able to grab a large share of passengers as India has been a rapidly growing and evolving aviation market, explains Sharat Dhall, COO (B2C) of online travel company Yatra.com. “There are a lot of first-time travellers who are upgrading from rail and bus travel and for them, price is of paramount importance,” he says. India’s cost conscious middle class with growing disposable income is also pushing up demand for cheap flights. “It’s a simple match and map. A majority of the population is not ultra-rich and, therefore, is looking for a good deal,” says Abrol.

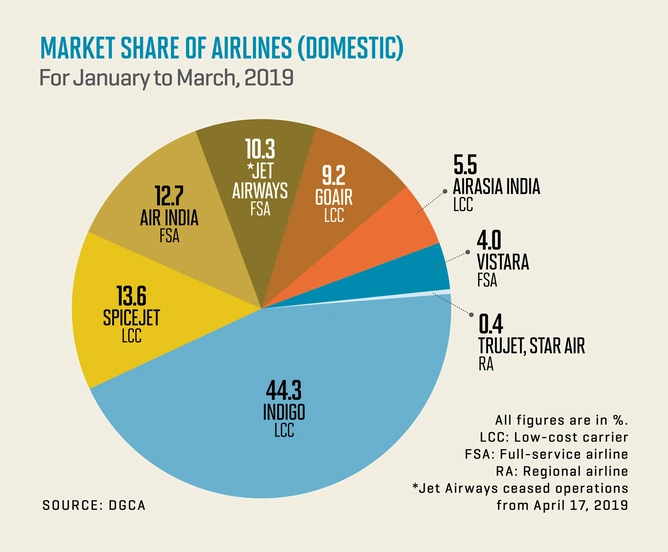

The debacle at Jet, which had an over 30% market share during its heyday, has given budget airlines an opportunity to gain more ground. According to data from the Directorate General of Civil Aviation, these airlines captured 73% of air traffic in the January-March quarter. But their growth in the past decade was mostly driven by high-flying IndiGo—the country’s largest airline with a market share of 44%.

Now, with nearly three-fourths of the Indian aviation market dominated by low-cost carriers, full-service airlines, which offer free food and other passenger-related frills, are struggling. Currently, there are only two operational full-service airlines, Air India and Vistara. Air India has been in the red for decades and Vistara too, reported losses of ₹431 crore in FY18, according to a Moneycontrol report. Despite the general scepticism about Jet Airways flying again, some analysts are still hopeful. If you dig into history, you find there is always some space for full-service carriers in India—despite the current market dynamics. “During the 2008 economic crisis, Indian (now Air India), Jet Airways, and Kingfisher Airlines (now defunct) had great occupancy numbers because customers were willing to pay,” says Martin, who was then vice-president of SpiceJet. At that time, full-service airlines accounted for over 50% of the domestic air travel market. “This is despite the fact GoAir, SpiceJet, and IndiGo had a sizeable fleet then.”

But Yatra’s Dhall believes at the moment there is just enough room for two full-service airlines in India. In that case, Jet Airways will need a new flight path.

Leave a Comment

Your email address will not be published. Required field are marked*